How Embedded finance is modernizing accounts receivable factoring

by Lonie Kemmer

Introduction to Embedded Finance and B2B BNPL

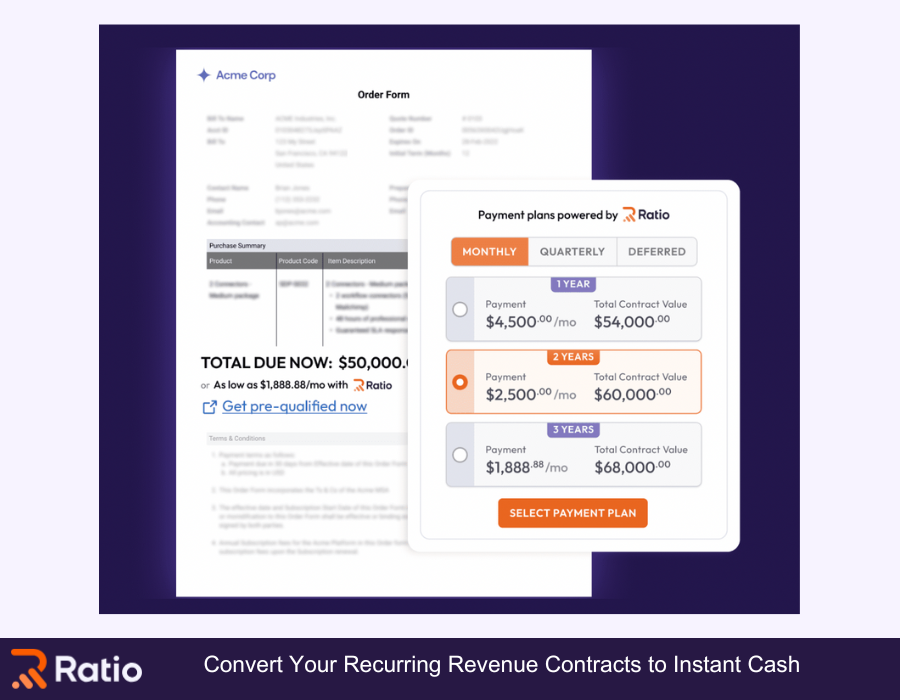

Embedded finance, which integrates financial services into non-financial customer experiences and platforms, is not a new concept. Historically, services like private label credit cards and sales financing by retailers have paved the way for today's innovations. Among these modern financial integrations, Buy Now, Pay Later (BNPL) models for B2B transactions represent a significant evolution. Ratio Tech is at the forefront of this shift, providing B2B BNPL solutions that enable smaller tech companies to offer seamless financing solutions. These companies can avoid the complexities typically associated with financial operations by using Ratio Tech’s streamlined services.

The Evolution of Accounts Receivable Factoring

The embedded finance movement is transforming how accounts receivable factoring is conducted by integrating financial services into platforms that consumers already use. This integration has led to enhanced accessibility and improved user experiences, shifting away from traditional banking products to more flexible financial services offered through familiar digital interfaces. As APIs and technology evolve, businesses are keen to open new revenue streams and adapt to changing consumer expectations, fueling rapid development in financial services.

Benefits of Embedded Finance in Accounts Receivable

Embedded finance revolutionizes BNPL transactions for B2B companies, enhancing efficiency and scalability. It allows businesses to bypass traditional financial institutions and manage transactions through technological solutions that improve their working capital positions and reduce operating costs. For instance, Ratio Tech simplifies financial transactions for its clients by managing BNPL arrangements that support both buyers and sellers, thus facilitating smoother business operations.

Technological Drivers Behind Modern Factoring

Innovations in technology play a crucial role in modernizing factoring processes. Automation and artificial intelligence are leveraged to streamline operations and enhance service offerings, making financial management more efficient and compliant. Embedded finance utilizes these technologies to integrate financial services into daily business operations seamlessly, making advanced financial management accessible to all businesses.

Impact of Embedded Finance on SaaS and Tech Companies

Embedded finance provides SaaS and tech companies with critical advantages, especially in managing cash flow and pricing structures. Companies that adopt Ratio Tech’s BNPL solutions can maintain consistent revenue streams without resorting to heavy discounts to encourage purchases. "Embedded BNPL solutions allow sellers to collect upfront payments while offering buyers the flexibility to manage their finances better," explains a Ratio Tech executive.

Case Studies: Success Stories in B2B BNPL

Embedded finance solutions have had a transformative impact on various businesses. A notable example is a startup trucking company that used Ratio Tech's BNPL services to manage large transactions without incurring debt liabilities on its financial books. This approach not only enhanced the company’s cash flow but also increased its sales by approximately 30%, demonstrating the significant advantages of embedded finance in B2B settings.

Legal and Regulatory Considerations

As embedded finance continues to expand, it encounters various legal and regulatory challenges, including compliance with AML/KYC requirements and data privacy laws. Navigating these complexities is essential for maintaining the integrity and trustworthiness of financial services.

Future Trends in B2B Financial Solutions

The future of B2B financial solutions lies in the continued integration of embedded finance. As businesses become more familiar with the benefits of B2B BNPL and other integrated financial services, demand is expected to grow. Ratio Tech is actively preparing to lead this evolution by adapting to and anticipating future trends, thus remaining at the cutting edge of financial technology.

Conclusion: The Strategic Advantage of Embedded Finance

Embedded finance offers transformative potential for B2B companies by seamlessly integrating essential financial services into their existing digital platforms. This integration enhances customer experiences, fosters loyalty, and creates new revenue opportunities. As the market continues to evolve, embedded finance is set to play a pivotal role in reshaping the financial landscape of B2B transactions.

Introduction to Embedded Finance and B2B BNPL Embedded finance, which integrates financial services into non-financial customer experiences and platforms, is not a new concept. Historically, services like private label credit cards and sales financing by retailers have paved the way for today's innovations. Among these modern financial integrations, Buy Now, Pay Later (BNPL) models for…

Recent Posts

- 5 Ways to Support Local Nonprofits in Lexington Without Donating Money

- How Airbnb Cleaning Services Handle Guest Messes in Chicago

- Protecting Your Rights as Duluth’s Leading Truck Accident Lawyer

- Common Pests Found in Cleveland Homes and How to Prevent Them

- Septic Tank Armadale Offers Comprehensive Septic Tank Cleaning Services for Perth Residents